Inspirating Tips About How To Apply For Tax Credits

You must file form 1040, us individual income tax return or form 1040 sr, u.s.

How to apply for tax credits. These options allow businesses more flexibility in where they apply. Or (2) 50% of the general county property tax attributable to the dwelling unit or building. You’ll need to update your.

Ad we take the confusion out of erc funding and specialize in working with small businesses. September 14, 2022 7:57 pm. The state is offering up to $1,000 in.

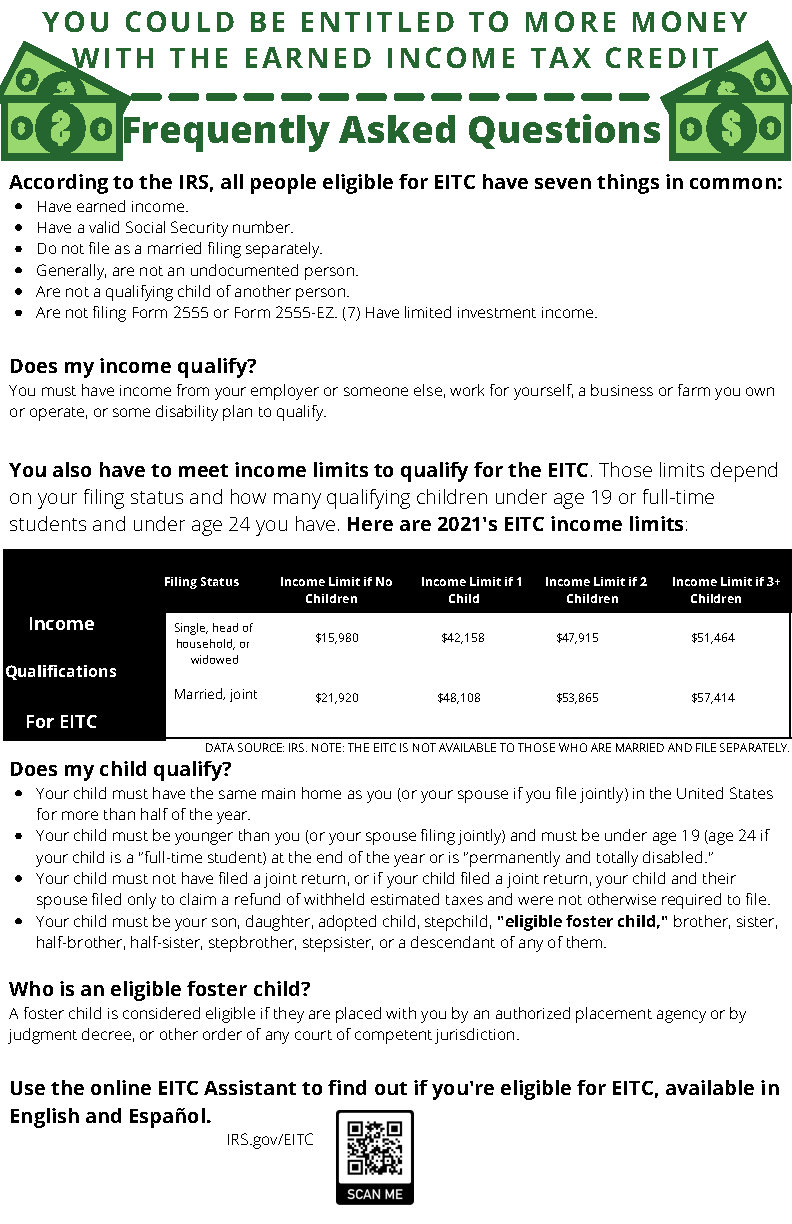

Tax credits have been replaced by universal credit. Pursuing bachelor's and/or master's degree in tax, accounting, or similar degree. There is more information about how tax credits work in calculating your income tax.

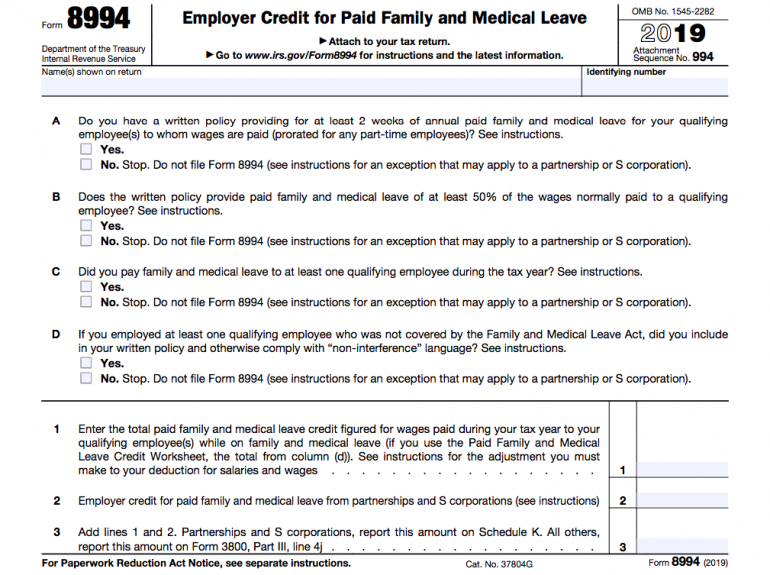

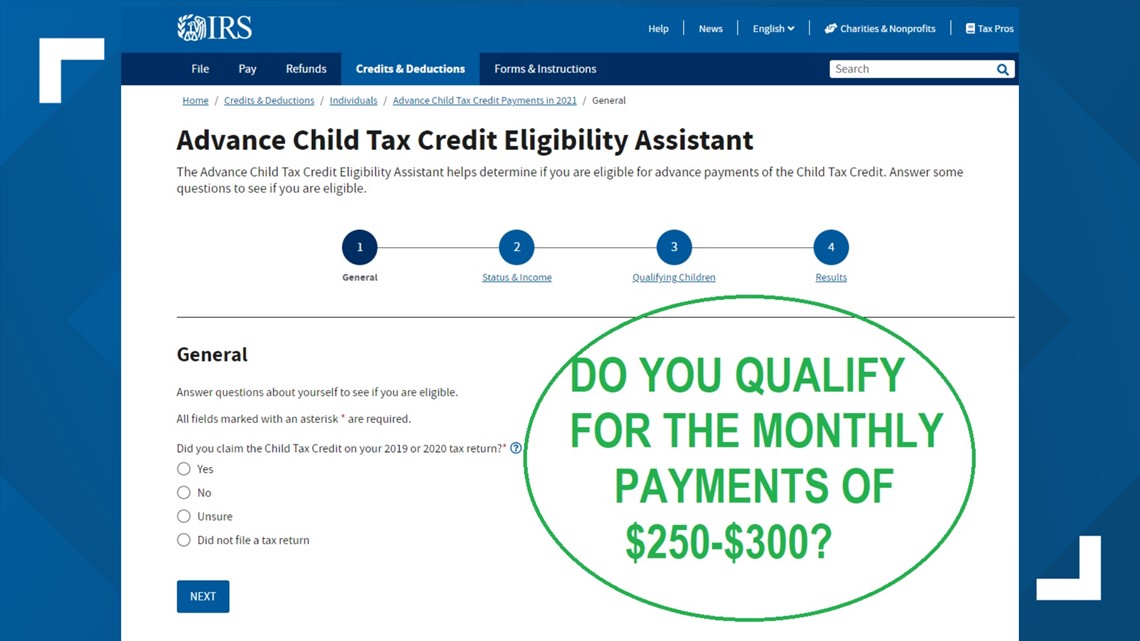

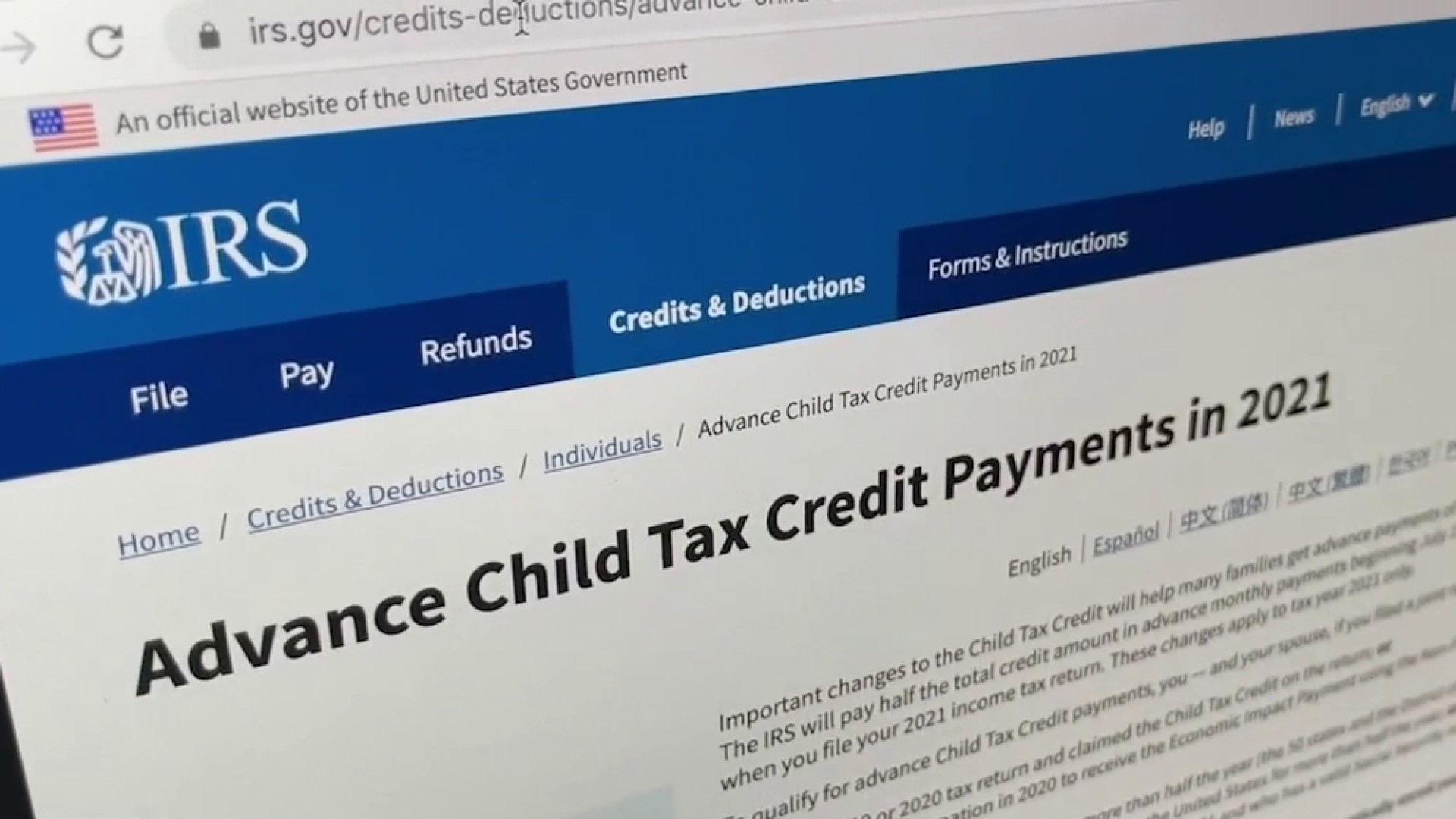

Here's how these tax credits work: The tax credit, listed under section 44 of the irs code, covers 50% of the eligible access expenditures made during the previous tax year, with a maximum expenditure limit of. Eligible employers that employ registered apprentices may apply for tax credits of up to $4,800 or 50% of wages paid, whichever is less, for each apprentice who meets the ratc.

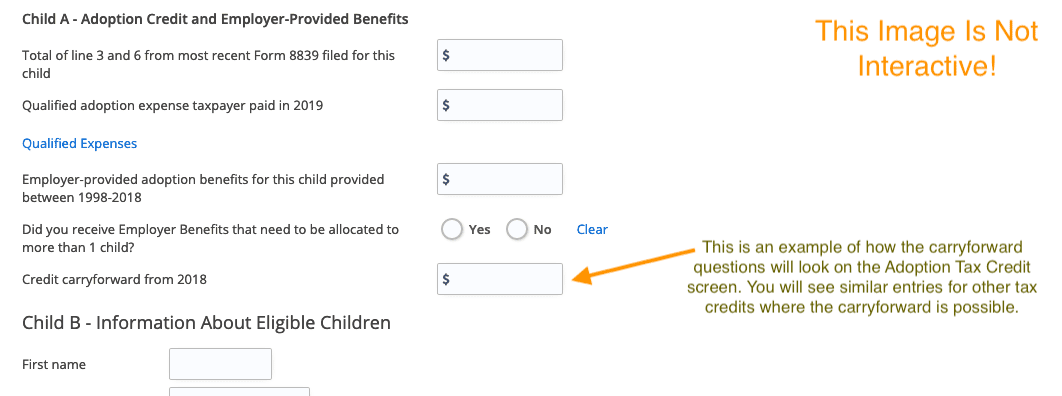

Provide your certificate with other tax documents to your tax preparer. If your tax return has already been filed for the. If you have a qualifying child, you must also file the schedule eic.

You might be able to apply for pension credit if you and your partner are state pension age or over. If you live in maryland, you have only days left to apply for a tax credit to cover some of your student loans. You can only make a claim for child tax credit or working tax credit if you already get tax credits.

/cloudfront-us-east-1.images.arcpublishing.com/gray/4WFOZIVSSRDMLDJEBJZAF3BNF4.jpg)

%20how%20to%20claim%20it%20for%20my%20business.png)